Methods Assume That What Has Occurred in the Past Will Continue to Occur in the Future

Time Series Methods

Time series methods are statistical techniques that make use of historical data accumulated over a period of time. Time series methods assume that what has occurred in the past will continue to occur in the future. As the name time series suggests, these methods relate the forecast to only one factor time . Time series methods tend to be most useful for short-range forecasting, although they can be used for longer-range forecasting. We will discuss two types of time series methods: the moving average and exponential smoothing .

Moving Average

A time series forecast can be as simple as using demand in the current period to predict demand in the next period. For example, if demand is 100 units this week, the forecast for next week's demand would be 100 units; if demand turned out to be 90 units instead, then the following week's demand would be 90 units, and so forth. This is sometimes referred to as na ve forecasting. However, this type of forecasting method does not take into account any type of historical demand behavior; it relies only on demand in the current period. As such, it reacts directly to the normal, random up-and-down movements in demand.

Alternatively, the moving average method uses several values during the recent past to develop a forecast. This tends to dampen , or smooth out , the random increases and decreases of a forecast that uses only one period. As such, the simple moving average is particularly useful for forecasting items that are relatively stable and do not display any pronounced behavior, such as a trend or seasonal pattern.

The moving average method is good for stable demand with no pronounced behavioral patterns .

Moving averages are computed for specific periods, such as 3 months or 5 months, depending on how much the forecaster desires to smooth the data. The longer the moving average period, the smoother it will be. The formula for computing the simple moving average is as follows :

where

n = number of periods in the moving average

D i = data in period i

To demonstrate the moving average forecasting method, we will use an example. The Instant Paper Clip Supply Company sells and delivers office supplies to various companies, schools , and agencies within a 30-mile radius of its warehouse. The office supply business is extremely competitive, and the ability to deliver orders promptly is an important factor in gettting new customers and keeping old ones. (Offices typically order not when their inventory of supplies is getting low but when they completely run out. As a result, they need their orders immediately.) The manager of the company wants to be certain that enough drivers and delivery vehicles are available so that orders can be delivered promptly. Therefore, the manager wants to be able to forecast the number of orders that will occur during the next month (i.e., to forecast the demand for deliveries).

From records of delivery orders, the manager has accumulated data for the past 10 months. These data are shown in Table 15.1.

Table 15.1. Orders for 10-month period

| Month | Orders Delivered per Month |

|---|---|

| January | 120 |

| February | 90 |

| March | 100 |

| April | 75 |

| May | 110 |

| June | 50 |

| July | 75 |

| August | 130 |

| September | 110 |

| October | 90 |

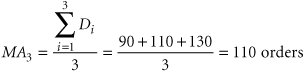

The moving average forecast is computed by dividing the sum of the values of the forecast variable, orders per month for a sequence of months, by the number of months in the sequence. Frequently, a moving average is calculated for three or five time periods. The forecast resulting from either the 3- or the 5-month moving average is typically for the next month in the sequence, which in this case is November. The moving average is computed from the demand for orders for the last 3 months in the sequence, according to the following formula:

The 5-month moving average is computed from the last 5 months of demand data, as follows:

The 3- and 5-month moving averages for all the months of demand data are shown in Table 15.2. Notice that we have computed forecasts for all the months. Actually, only the forecast for November, based on the most recent monthly demand, would be used by the manager. However, the earlier forecasts for prior months allow us to compare the forecast with actual demand to see how accurate the forecasting method is (i.e., how well it does).

Table 15.2. 3- and 5-month averages

| Month | Orders per Month | 3-Month Moving Average | 5-Month Moving Average |

|---|---|---|---|

| January | 120 | ||

| February | 90 | ||

| March | 100 | ||

| April | 75 | 103.3 | |

| May | 110 | 88.3 | |

| June | 50 | 95.0 | 99.0 |

| July | 75 | 78.3 | 85.0 |

| August | 130 | 78.3 | 82.0 |

| September | 110 | 85.0 | 88.0 |

| October | 90 | 105.0 | 95.0 |

| November | 110.0 | 91.0 |

Both moving average forecasts in Table 15.2 tend to smooth out the variability occurring in the actual data. This smoothing effect can be observed in Figure 15.2, in which the 3-month and 5-month averages have been superimposed on a graph of the original data. The extremes in the actual orders per month have been reduced. This is beneficial if these extremes simply reflect random fluctuations in orders per month because our moving average forecast will not be strongly influenced by them.

Figure 15.2. 3- and 5-month moving averages

(This item is displayed on page 672 in the print version)

Notice that the 5-month moving average in Figure 15.2 smooths out fluctuations to a greater extent than the 3-month moving average. However, the 3-month average more closely reflects the most recent data available to the office supply manager. (The 5-month average forecast considers data all the way back to June; the 3-month average does so only to August.) In general, forecasts computed using the longer-period moving average are slower to react to recent changes in demand than those made using shorter-period moving averages. The extra periods of data dampen the speed with which the forecast responds. Establishing the appropriate number of periods to use in a moving average forecast often requires some amount of trial-and-error experimentation.

Longer-period moving averages react more slowly to recent demand changes than do shorter-period moving averages .

One additional point to mention relates to the period of the forecast. Sometimes a forecaster will need to forecast for a short planning horizon rather than just a single period. For both the 3- and 5-month moving average forecasts computed in Table 15.2, the final forecast is for one period only in the future. Because the moving average includes multiple periods of data for each forecast, and it is most often used to forecast in a stable demand environment, it would be appropriate to use the forecast for multiple periods in the future. It could then be updated as actual demand data became available.

The major disadvantage of the moving average method is that it does not react well to variations that occur for a reason, such as trends and seasonal effects (although this method does reflect trends to a moderate extent). Those factors that cause changes are generally ignored. It is basically a "mechanical" method, which reflects historical data in a consistent fashion. However, the moving average method does have the advantage of being easy to use, quick, and relatively inexpensive, although moving averages for a substantial number of periods for many different items can result in the accumulation and storage of a large amount of data. In general, this method can provide a good forecast for the short run, but an attempt should not be made to push the forecast too far into the distant future.

Weighted Moving Average

The moving average method can be adjusted to reflect more closely more recent fluctuations in the data and seasonal effects. This adjusted method is referred to as a weighted moving average method. In this method, weights are assigned to the most recent data according to the following formula:

where

| W i | = | the weight for period i , between 0% and 100% |

| S W i | = | 1.00 |

In a weighted moving average , weights are assigned to the most recent data .

For example, if the Instant Paper Clip Supply Company wants to compute a 3-month weighted moving average with a weight of 50% for the October data, a weight of 33% for the September data, and a weight of 17% for August, it is computed as

Notice that the forecast includes a fractional part, .4. Because .4 order would be impossible , this appears to be unrealistic . In general, the fractional parts need to be included in the computation to achieve mathematical accuracy, but when the final forecast is achieved, it must be rounded up or down.

Management Science Application: Product Forecasting at Nabisco

Nabisco Biscuit Company is the largest domestic operating company within Nabisco, a Fortune 500 company with $9 billion in annual sales. Nabisco Biscuit Company is the largest cookie and cracker manufacturing company in the United States, with annual sales of $3.5 billion. More than 30 company-owned and contract bakeries produce hundreds of different cookie, cracker, and snack products, including Oreo, Chips Ahoy!, Ritz, and Snack -Wells. These products are shipped from the bakeries to more than 100 distribution center warehouses throughout the United States, and then from these distribution centers, Nabisco delivers orders to more than 100,000 final destinations, mostly retail grocery and convenience stores. Orders placed with a distribution center are delivered to a store within a short lead-time period, typically 24 to 48 hours. An accurate weekly forecast of product demand from the distribution centers is particularly critical to Nabisco because of the short lead time for orders, the wide geographic dispersion of the distribution centers, the large number of Nabisco products, and the limited product shelf life of bakery products. The forecasting process is complicated by product promotional events at the stores and the continuous introduction of new products.

Nabisco uses what is referred to as a top-down approach to forecasting. It starts with a national production forecast for each product for a 4-week sales period. This national forecast considers information from finance and marketing and from a national product promotional schedule. It is provided to the distribution centers on a weekly basis to help create weekly forecasts of product demand, using statistical forecasting methods based on sales history. One of the forecast techniques it uses is a moving average. This demand forecast is combined with a statistical forecast based on individual account (e.g., store) promotional events and activities. Nabisco then uses this combined set of forecasts to determine the appropriate shipments from the bakeries to the distribution centers.

Forecasts for new products present Nabisco with a different challenge. Most of the forecasting techniques used for existing products are developed using several years of historical data, which are not available for new products. At Nabisco a planning forecast is used to develop initial production planning and scheduling and to set initial inventory levels for a new product. However, when the product is introduced, which is generally a gradual process across different geographic regions , actual sales can be different than planned, depending on consumer acceptance of the product. If consumer acceptance is greater than planned, the company can expect shortages and lost sales. If consumer demand is lower than planned and the new product fails, the company can be stuck with excess inventory that must be destroyed . Thus, it is important that Nabisco be able to adjust its forecasts quickly during the product introductory period so that they will be as accurate as possible. Nabisco uses a forecast model for new products developed using the exponential smoothing technique, with adjustments for trend and seasonality (one of the forecast techniques presented in this chapter).

Sources: S. Amrute, "Forecasting New Products with Limited History: Nabisco's Experience," Journal of Business Forecasting 17, no. 3 (Fall 1998): 711; M. Barash and D. Mitchell, "Account Based Forecasting at Nabisco Biscuit Company," Journal of Business Forecasting 17, no. 2 (Summer 1998): 36.

Also notice that this forecast is slightly lower than our previously computed 3-month average forecast of 110 orders, reflecting the lower number of orders in October (the most recent month in the sequence).

Determining the precise weights to use for each period of data frequently requires some trial-and-error experimentation, as does determining the exact number of periods to include in the moving average. If the most recent months are weighted too heavily, the forecast might overreact to a random fluctuation in orders; if they are weighted too lightly, the forecast might underreact to an actual change in the pattern of orders.

Exponential Smoothing

The exponential smoothing forecast method is an averaging method that weights the most recent past data more strongly than more distant past data. Thus, the forecast will react more strongly to immediate changes in the data. This is very useful if the recent changes in the data are the results of an actual change (e.g., a seasonal pattern) instead of just random fluctuations (for which a simple moving average forecast would suffice).

Exponential smoothing is an averaging method that reacts more strongly to recent changes in demand than to more distant past data .

We will consider two forms of exponential smoothing: simple exponential smoothing and adjusted exponential smoothing (adjusted for trends, seasonal patterns, etc.). We will discuss the simple exponential smoothing case first, followed by the adjusted form.

To demonstrate simple exponential smoothing, we will return to the Instant Paper Clip Supply Company example. The simple exponential smoothing forecast is computed by using the formula

F t +1 = a D t + (1 a ) F t

where

| F t +1 | = | the forecast for the next period |

| D t | = | actual demand in the present period |

| F t | = | the previously determined forecast for the present period |

| a | = | a weighting factor referred to as the smoothing constant |

Management Science Application: Forecasting Customer Demand at Taco Bell

Taco Bell is an international fast-food business with 6,500 locations worldwide, with annual sales of approximately $4.6 billion.

Labor costs at Taco Bell are approximately 30% of every sales dollar, and these costs are very difficult to manage because labor is so closely linked to sales demand. It is not possible for Taco Bell to produce its food products in advance and store them in inventory like a manufacturing company; instead, it must prepare its food products on demandthat is, when they are ordered. Demand is highly variable during both the day and the week, with 52% of sales occurring during the 3- hour lunch period from 11:00 A.M. to 2:00 P.M. Determining how many employees to schedule at given times during the day is very difficult. This problem is exacerbated by the fact that quality service is determined by the speed of service.

To develop an effective labor-management system, Taco Bell needed an accurate forecasting model to predict customer demandthat is, arrivals and sales. Taco Bell determined that the best forecasting method was a 6-week moving average for each 15-minute interval of every day of the week. For example, customer demand at a particular restaurant for all Thursdays from 11:00 A.M. to 11:15 A.M. for a 6-week period constitutes the time series database to forecast customer transactions for the next Thursday in the future. On a weekly basis, the forecasts are compared to statistical forecasting control limits that are continuously updated, and the length of the moving average is adjusted when the forecasts move out of control. Taco Bell achieved labor savings of over $40 million from 1993 to 1996 by using the new labor-management system, of which this forecasting model is an integral part.

Source: J. Hueter and W. Swart, "An Integrated Labor-Management System for Taco Bell," Interfaces 28, no. 1 (JanuaryFebruary 1998): 7591.

The smoothing constant, a , is between zero and one. It reflects the weight given to the most recent demand data. For example, if a = .20,

F t +1 = .20 D t + .80 F t

which means that our forecast for the next period is based on 20% of recent demand ( D t ) and 80% of past demand (in the form of the forecast F t because F t is derived from previous demands and forecasts). If we go to one extreme and let a = 0.0, then

![]()

and the forecast for the next period is the same as for this period. In other words, the forecast does not reflect the most recent demand at all .

On the other hand, if a = 1.0, then

The closer a is to one, the greater the reaction to the most recent demand .

![]()

and we have considered only the most recent occurrence in our data (demand in the present period) and nothing else. Thus, we can conclude that the higher a is, the more sensitive the forecast will be to changes in recent demand. Alternatively, the closer a is to zero, the greater will be the dampening or smoothing effect. As a approaches zero, the forecast will react and adjust more slowly to differences between the actual demand and the forecasted demand. The most commonly used values of a are in the range from .01 to .50. However, the determination of a is usually judgmental and subjective and will often be based on trial-and-error experimentation. An inaccurate estimate of a can limit the usefulness of this forecasting technique.

To demonstrate the computation of an exponentially smoothed forecast, we will use an example. PM Computer Services assembles customized personal computers from generic parts. The company was formed and is operated by two part-time State University students, Paulette Tyler and Maureen Becker, and has had steady growth since it started. The company assembles computers mostly at night, using other part-time students as labor. Paulette and Maureen purchase generic computer parts in volume at a discount from a variety of sources whenever they see a good deal. It is therefore important that they develop a good forecast of demand for their computers so that they will know how many computer component parts to purchase and stock.

The company has accumulated the demand data in Table 15.3 for its computers for the past 12 months, from which it wants to compute exponential smoothing forecasts, using smoothing constants ( a ) equal to .30 and .50.

Table 15.3. Demand for personal computers

| Period | Month | Demand |

|---|---|---|

| 1 | January | 37 |

| 2 | February | 40 |

| 3 | March | 41 |

| 4 | April | 37 |

| 5 | May | 45 |

| 6 | June | 50 |

| 7 | July | 43 |

| 8 | August | 47 |

| 9 | September | 56 |

| 10 | October | 52 |

| 11 | November | 55 |

| 12 | December | 54 |

To develop the series of forecasts for the data in Table 15.3, we will start with period 1 (January) and compute the forecast for period 2 (February) by using a = .30. The formula for exponential smoothing also requires a forecast for period 1, which we do not have, so we will use the demand for period 1 as both demand and the forecast for period 1 . Other ways to determine a starting forecast include averaging the first three or four periods and making a subjective estimate. Thus, the forecast for February is

F 2 = a D 1 + (1 a ) F 1 = (.30)(37) + (.70)(37) = 37 units

The forecast for period 3 is computed similarly:

F 3 = a D 2 + (1 a ) F 2 = (.30)(40) + (.70)(37) = 37.9 units

The remaining monthly forecasts are shown in Table 15.4. The final forecast is for period 13, January, and is the forecast of interest to PM Computer Services:

F 13 = a D 12 + (1 a ) F 12 = (.30)(54) + (.70)(50.84) = 51.79 units

Table 15.4 also includes the forecast values by using a = .50. Both exponential smoothing forecasts are shown in Figure 15.3, together with the actual data.

Figure 15.3. Exponential smoothing forecasts

Table 15.4. Exponential smoothing forecasts, a = .30 and a = .50

| Forecast, F t + 1 | ||||

|---|---|---|---|---|

| Period | Month | Demand | a = .30 | a = .50 |

| 1 | January | 37 | ||

| 2 | February | 40 | 37.00 | 37.00 |

| 3 | March | 41 | 37.90 | 38.50 |

| 4 | April | 37 | 38.83 | 39.75 |

| 5 | May | 45 | 38.28 | 38.37 |

| 6 | June | 50 | 40.29 | 41.68 |

| 7 | July | 43 | 43.20 | 45.84 |

| 8 | August | 47 | 43.14 | 44.42 |

| 9 | September | 56 | 44.30 | 45.71 |

| 10 | October | 52 | 47.81 | 50.85 |

| 11 | November | 55 | 49.06 | 51.42 |

| 12 | December | 54 | 50.84 | 53.21 |

| 13 | January | 51.79 | 53.61 | |

In Figure 15.3, the forecast using the higher smoothing constant, a = .50, reacts more strongly to changes in demand than does the forecast with a = .30, although both smooth out the random fluctuations in the forecast. Notice that both forecasts lag behind the actual demand. For example, a pronounced downward change in demand in July is not reflected in the forecast until August. If these changes mark a change in trend (i.e., a long- term upward or downward movement) rather than just a random fluctuation, then the forecast will always lag behind this trend. We can see a general upward trend in delivered orders throughout the year. Both forecasts tend to be consistently lower than the actual demand; that is, the forecasts lag behind the trend.

Based on simple observation of the two forecasts in Figure 15.3, a = .50 seems to be the more accurate of the two, in the sense that it seems to follow the actual data more closely. (Later in this chapter we will discuss several quantitative methods for determining forecast accuracy.) In general, when demand is relatively stable, without any trend, using a small value for a is more appropriate to simply smooth out the forecast. Alternatively, when actual demand displays an increasing (or decreasing ) trend, as is the case in Figure 15.3, a larger value of a is generally better. It will react more quickly to the more recent upward or downward movements in the actual data. In some approaches to exponential smoothing, the accuracy of the forecast is monitored in terms of the difference between the actual values and the forecasted values. If these differences become larger, then a is changed (higher or lower) in an attempt to adapt the forecast to the actual data. However, the exponential smoothing forecast can also be adjusted for the effects of a trend.

As we noted with the moving average forecast, the forecaster sometimes needs a forecast for more than one period into the future. In our PM Computer Services example, the final forecast computed was for 1 month, January. A forecast for 2 or 3 months could have been computed by grouping the demand data into the required number of periods and then using these values in the exponential smoothing computations . For example, if a 3-month forecast were needed, demand for January, February, and March could be summed and used to compute the forecast for the next 3-month period, and so on, until a final 3-month forecast resulted. Alternatively, if a trend were present, the final period forecast could be used for an extended forecast by adjusting it by a trend factor.

Adjusted Exponential Smoothing

The adjusted exponential smoothing forecast consists of the exponential smoothing forecast with a trend adjustment factor added to it. The formula for the adjusted forecast is

Adjusted exponential smoothing is the exponential smoothing forecast with an adjustment for a trend added to it .

AF t +1 = F t +1 + T t +1

where

T = an exponentially smoothed trend factor

The trend factor is computed much the same as the exponentially smoothed forecast. It is, in effect, a forecast model for trend:

T t +1 = b ( F t +1 - F t ) + (1 - b ) T t

where

T t = the last period trend factor

b = a smoothing constant for trend

Like a , b is a value between zero and one. It reflects the weight given to the most recent trend data. Also like a , b is often determined subjectively, based on the judgment of the forecaster. A high b reflects trend changes more than a low b . It is not uncommon for b to equal a in this method.

The closer b is to one, the stronger a trend is reflected .

Notice that this formula for the trend factor reflects a weighted measure of the increase (or decrease) between the current forecast, F t + 1 , and the previous forecast, F t .

As an example, PM Computer Services now wants to develop an adjusted exponentially smoothed forecast, using the same 12 months of demand shown in Table 15.3. It will use the exponentially smoothed forecast with a = .50 computed in Table 15.4 with a smoothing constant for trend, b , of .30.

The formula for the adjusted exponential smoothing forecast requires an initial value for T t to start the computational process. This initial trend factor is most often an estimate determined subjectively or based on past data by the forecaster. In this case, because we have a relatively long sequence of demand data (i.e., 12 months), we will start with the trend, T t , equal to zero. By the time the forecast value of interest, F 13 , is computed, we should have a relatively good value for the trend factor.

The adjusted forecast for February, AF 2 , is the same as the exponentially smoothed forecast because the trend computing factor will be zero (i.e., F 1 and F 2 are the same and T 2 = 0). Thus, we will compute the adjusted forecast for March, AF 3 , as follows, starting with the determination of the trend factor, T 3 :

T 3 = b ( F 3 F 2 ) + (1 b ) T 2 = (.30)(38.5 37.0) + (.70)(0) = 0.45

and

AF 3 = F 3 + T 3 = 38.5 + 0.45 = 38.95

This adjusted forecast value for period 3 is shown in Table 15.5, with all other adjusted forecast values for the 12-month period plus the forecast for period 13, computed as follows:

T 13 = b ( F 13 F 12 ) + (1 b ) T 12 = (.30)(53.61 53.21) + (.70)(1.77) = 1.36

and

AF 13 = F 13 + T 13 = 53.61 + 1.36 = 54.96 units

Table 15.5. Adjusted exponentially smoothed forecast values

| Period | Month | Demand | Forecast | Trend ( T t +1 ) | Adjusted Forecast ( AF t +1 ) |

|---|---|---|---|---|---|

| 1 | January | 37 | 37.00 | ||

| 2 | February | 40 | 37.00 | 0.00 | 37.00 |

| 3 | March | 41 | 38.50 | 0.45 | 38.95 |

| 4 | April | 37 | 39.75 | 0.69 | 40.44 |

| 5 | May | 45 | 38.37 | 0.07 | 38.44 |

| 6 | June | 50 | 41.68 | 1.04 | 42.73 |

| 7 | July | 43 | 45.84 | 1.97 | 47.82 |

| 8 | August | 47 | 44.42 | 0.95 | 45.37 |

| 9 | September | 56 | 45.71 | 1.05 | 46.76 |

| 10 | October | 52 | 50.85 | 2.28 | 53.13 |

| 11 | November | 55 | 51.42 | 1.76 | 53.19 |

| 12 | December | 54 | 53.21 | 1.77 | 54.98 |

| 13 | January | 53.61 | 1.36 | 54.96 |

The adjusted exponentially smoothed forecast values shown in Table 15.5 are compared with the exponentially smoothed forecast values and the actual data in Figure 15.4.

Figure 15.4. Adjusted, exponentially smoothed forecast

(This item is displayed on page 679 in the print version)

Notice that the adjusted forecast is consistently higher than the exponentially smoothed forecast and is thus more reflective of the generally increasing trend of the actual data. However, in general, the pattern, or degree of smoothing, is very similar for both forecasts.

Linear Trend Line

Linear regression is most often thought of as a causal method of forecasting in which a mathematical relationship is developed between demand and some other factor that causes demand behavior. However, when demand displays an obvious trend over time, a least squares regression line, or linear trend line , can be used to forecast demand.

A linear trend line is a linear regression model that relates demand to time .

Management Science Application: Seasonal Forecasting at Dell

Dell is the largest computer company in the world. Its founder, Michael Dell, formed the company based on the idea of selling personal computers directly to customers and bypassing retailers; Dell Inc. sells computer systems directly to customers via phone and Internet orders. Once an order is received and processed , it is sent to an assembly plant in Austin, Texas, where Dell builds, tests, and packages a product within 8 hours.

Dell's direct sales model is dependent upon its arrangements with its suppliers, many of which are located in Southeast Asia, with shipping times to Austin of 7 to 30 days. To compensate for these long lead times, Dell requires its suppliers to keep specified (i.e., target) inventory levelstypically 10 days of inventoryon hand at small warehouses, called "revolvers" (short for revolving inventory ). In this type of vendor-managed inventory (VMI) arrangement, Dell's suppliers determine how much inventory to order and when to order to meet Dell's target inventory levels at the revolvers.

To help its suppliers make good ordering decisions, Dell shares its demand forecast with them on a monthly basis. Dell uses a 6-month rolling forecast developed by its marketing department that is updated weekly. Buyers receive weekly forecasts from commodity teams that break down the forecasts for specific parts and components . These forecasts reflect product-specific trends and seasonality. For home computer systems, Christmas is the major sales period of the year. Other high-demand periods include the back-to-school season and the end of the year, when the government makes big purchases.

Source: R. Kapuscinski, R. Zhang, P. Carbonneau, R. Moore, and B. Reeves, "Inventory Decisions in Dell's Supply Chain," Interfaces 34, no. 3 (MayJune 2004): 191205.

A linear trend line relates a dependent variable, which for our purposes is demand, to one independent variable, time, in the form of a linear equation, as follows:

y = a + bx

where

a = intercept (at period 0)

b = slope of the line

x = the time period

y = forecast for demand for period x

These parameters of the linear trend line can be calculated by using the least squares formulas for linear regression:

As an example, consider the demand data for PM Computer Services shown in Table 15.3. They appear to follow an increasing linear trend. As such, the company wants to compute a linear trend line as an alternative to the exponential smoothing and adjusted exponential smoothing forecasts shown in Tables 15.4 and 15.5. The values that are required for the least squares calculations are shown in Table 15.6.

Table 15.6. Least squares calculations

| x (period) | y (demand) | xy | x 2 |

|---|---|---|---|

| 1 | 37 | 37 | 1 |

| 2 | 40 | 80 | 4 |

| 3 | 41 | 123 | 9 |

| 4 | 37 | 148 | 16 |

| 5 | 45 | 225 | 25 |

| 6 | 50 | 300 | 36 |

| 7 | 43 | 301 | 49 |

| 8 | 47 | 376 | 64 |

| 9 | 56 | 504 | 81 |

| 10 | 52 | 520 | 100 |

| 11 | 55 | 605 | 121 |

| 12 | 54 | 648 | 144 |

| 78 | 557 | 3,867 | 650 |

Using these values for  and

and  and the values from Table 15.6, the parameters for the linear trend line are computed as follows:

and the values from Table 15.6, the parameters for the linear trend line are computed as follows:

Therefore, the linear trend line is

y = 35.2 + 1.72 x

To calculate a forecast for period 13, x = 13 would be substituted in the linear trend line:

y = 35.2 + 1.72(13) = 57.56

Figure 15.5 shows the linear trend line in comparison to the actual data. The trend line visibly appears to closely reflect the actual data (i.e., to be a "good fit") and would thus be a good forecast model for this problem. However, a disadvantage of the linear trend line is that it will not adjust to a change in the trend as the exponential smoothing forecast methods will (i.e., it is assumed that all future forecasts will follow a straight line). This limits the use of this method to a shorter time frame in which the forecaster is relatively certain that the trend will not change.

Figure 15.5. Linear trend line

A linear trend line will not adjust to a change in trend as will exponential smoothing .

Seasonal Adjustments

As we mentioned at the beginning of this chapter, a seasonal pattern is a repetitive up-and-down movement in demand. Many demand items exhibit seasonal behavior. Clothing sales follow annual seasonal patterns, with demand for warm clothes increasing in the fall and winter and declining in the spring and summer, as the demand for cooler clothing increases. Demand for many retail itemsincluding toys, sports equipment, clothing, electronic appliances, hams, turkeys, wine, and fruitincreases during the Christmas season. Greeting card demand increases in conjunction with various special days, such as Valentine's Day and Mother's Day. Seasonal patterns can also occur on a monthly, weekly, or even daily basis. Some restaurants have higher demand in the evening than at lunch, or on weekends as opposed to weekdays. Traffic and sales picks up at shopping malls on Friday and Saturday.

There are several methods available for reflecting seasonal patterns in a time series forecast. We will describe one of the simpler methodsusing a seasonal factor , which is a numerical value that is multiplied by the normal forecast to get a seasonally adjusted forecast.

It is possible to adjust for seasonality by multiplying the normal forecast by a seasonal factor .

One method for developing a demand for seasonal factors is dividing the actual demand for each seasonal period by the total annual demand, according to the following formula:

![]()

The resulting seasonal factors between zero and one are, in effect, the portion of total annual demand assigned to each season. These seasonal factors are thus multiplied by the annual forecasted demand to yield seasonally adjusted forecasts for each period.

As an example, Wishbone Farms is a company that raises turkeys, which it sells to a meat-processing company throughout the year. However, the peak season obviously occurs during the fourth quarter of the year, October to December. Wishbone Farms has experienced a demand for turkeys for the past 3 years as shown in Table 15.7.

Table 15.7. Demand for turkeys at Wishbone Farms

| Demand (1,000s) | |||||

| Year | Q UARTER 1 | Q UARTER 2 | Q UARTER 3 | Q UARTER 4 | T OTAL |

| 2003 | 12.6 | 8.6 | 6.3 | 17.5 | 45.0 |

| 2004 | 14.1 | 10.3 | 7.5 | 18.2 | 50.1 |

| 2005 | 15.3 | 10.6 | 8.1 | 19.6 | 53.6 |

| Total | 42.0 | 29.5 | 21.9 | 55.3 | 148.7 |

Because we have 3 years of demand data, we can compute the seasonal factors by dividing total quarterly demand for the 3 years by total demand across all 3 years:

Next, we want to multiply the forecasted demand for the next year, 2006, by each of the seasonal factors to get the forecasted demand for each quarter. However, to accomplish this, we need a demand forecast for 2006. In this case, because the demand data in Table 15.7 seem to exhibit a generally increasing trend, we compute a linear trend line for the 3 years of data in Table 15.7 to use as a rough forecast estimate:

y = 40.97 + 4.30 x = 40.97 + 4.30(4) = 58.17

Thus, the forecast for 2006 is 58.17, or 58,170 turkeys.

Using this annual forecast of demand, the seasonally adjusted forecasts, SF i , for 2006 are as follows:

SF 1 = ( S 1 )( F 5 ) = (.28)(58.17) = 16.28

SF 2 = ( S 2 )( F 5 ) = (.20)(58.17) = 11.63

SF 3 = ( S 3 )( F 5 ) = (.15)(58.17) = 8.73

SF 4 = ( S 4 )( F 5 ) = (.37)(58.17) = 21.53

Comparing these quarterly forecasts with the actual demand values in Table 15.7 shows them to be relatively good forecast estimates, reflecting both the seasonal variations in the data and the general upward trend.

Management Science Application: Forecasting Service Calls at FedEx

FedEx is the world's largest express delivery company, with annual revenues of $14 billion. With a workforce of 145,000 employees, 600 planes, and 42,000 ground vehicles, it delivers more than 3 million packages per day to 210 countries . To support its global delivery network, FedEx has 51 customer service call centers, including 16 in the United States and 35 overseas. The customer service centers in the United States handle about 500,000 calls daily for requests for pickup, drop-off locations, package tracking, package rating, and so on. FedEx's service level goal is to answer 90% of all calls within 20 seconds, and it has some of the highest customer satisfaction levels in the industry.

FedEx has three major service call networks: domestic for calls related to packages sent and delivered within the United States; international for packages sent overseas from the United States; and freight for calls related to packages over 150 pounds . For each of these call networks, FedEx uses four different forecasts, encompassing different forecasting horizons: strategic plan, business plan, tactical forecast, and operational forecast. The strategic plan is for a 5-year horizon and includes forecasts for the number of calls to service representatives, average call handling time, staffing requirements, and technology calls. This plan is revised and updated once a year. The business plan includes the same forecasts as the strategic plan, except it is for a 1-year horizon, with updates and revisions as management requires. The tactical forecast is a daily forecast of the number of calls offered to service representatives, provided once per month and rolled over for 6 months. The goal for the tactical forecast is to be within a 2% error per month and within a 4% error on a daily basis. The operational forecast is a daily forecast of the number of calls offered to service representatives and the average call handle time per half hour. It is prepared on a weekly basis and forecasted 1 month in advance.

The forecasting models used include exponential smoothing, linear regression, and time series, with adjustments for trend and seasonality. For example, the tactical forecast employs a time series model based on 8 years of historical data, with adjustments for seasonalitiesthat is, month, week, day, and day of month. Trend adjustments are also used.

Source: W. Xu, "Long Range Planning for Call Centers at FedEx," Journal of Business Forecasting 18, no. 4 (Winter 1999-2000): 7-11.

Source: https://flylib.com/books/en/3.287.1.202/1/

0 Response to "Methods Assume That What Has Occurred in the Past Will Continue to Occur in the Future"

Post a Comment